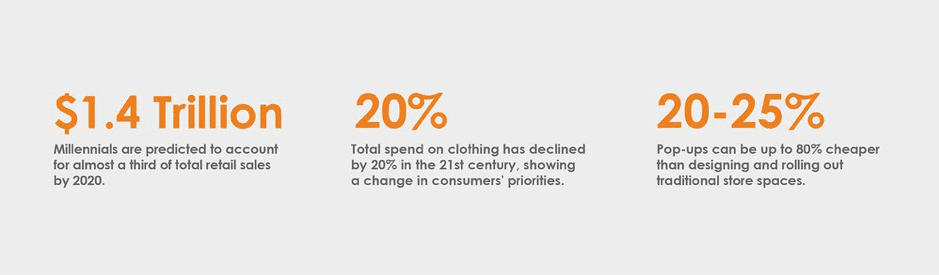

Millennials and Gen Z are changing the retail game. In this 2-part article, I highlight how retailers use temporary spaces like pop-ups and store-in-stores to up their customer experiences and engage the younger generation.

A wide variety of brands are embracing pop-up culture: e-commerce retailers looking to establish a physical presence, content brands hoping to build brand affinity, and traditional retailers aiming to generate buzz and drive online conversions.

“In my experience working with fashion and lifestyle brands, pop-ups can be extremely successful if they are built around a specific goal. The goal can be to test a new market or geography, or to expand audiences by collaborating with other brands. Whatever the goal, it’s important to keep it at the forefront throughout the planning process.”

Pop-ups directly feed on the experientialapproach, which is the number one thing retailers need to invest in right now if they want to focus on drawing Millennials and Gen Z. The rise of social media along with the shift of consumer attention from ownership to experiences have had a significant impact on the way brands market and sell their products.

THE CHALLENGE: WHAT IS HAPPENING TO BRICK-AND-MORTAR?

“In 2019, consumers are more empowered and ‘in charge’ of their shopping behaviour than ever before – transparency in pricing, easier access to product comparisons, and a much wider marketplace pool to choose from”

Despite doomsday predictions, brick-and-mortar isn’t drowning but, instead, has found a new role in the retail shopping ecosystem. Physical store spaces are less focused on stocking and moving inventory, shifting their attention to communicating brand values, collecting customer data, and providing personalised product experiences.

TEMPORARY SPACES AS A COST-EFFICIENT SOLUTION

“To roll out a pop-up, only about 20-25%% of the setup costs needed for traditional physical retail outlets is needed. Not only is it considerably more cost-efficient than designing and delivering longer term spaces, it’s also much simpler in terms of planning, documentation and build.”

HOW DO BRANDS CHOOSE A POP-UP MODEL THAT WORKS?

From a design perspective, the planning stage is the most important in delivering pop-ups. Since the pop-up concept offers a different retail experience compared to the typical brick-and-mortar location, retailers must start the planning process at least three months before opening a pop-up space.

The value of temporary spaces lies in their sense of exclusivity and ‘urgency’, thus requiring retailers to plan far in advance to cover all facets of merchandise buying, location, design and marketing.

For retailers unsure about setting up a standalone pop-up location, the store-within-a-store concept can be a viable alternative. Several brands have partnered with major retailers, such as Myer or David Jones, to showcase and sell related relevant items in-store. These partnerships enable brands to introduce their products in an atypical store offering, with the goal of broadening their appeal among new consumers.

WHAT IS THE DIFFERENCE BETWEEN STANDALONE POP-UPS AND STORE-IN-STORES?

‘Store-in-stores’ offer a better solution for the goal of driving sales, while pop-ups tend to be more experience-focused.

“Traditional standalone pop-up stores suit retailers that want to stay in control of all aspects of the store design without having to gain additional approvals through a third-party store operator. Projects of this nature require a great deal of planning: finding the right location, ideation and planning, design and procurement, approvals and installation… In an ideal world we would love more than three months to ensure a seamless execution. Anything shorter than this normally causes compromise, which is the last thing we want.”

Arguably, location is the most significant factor to consider when building a pop-up shop. With limited time in the spotlight, pop-ups need to be located in an area that will attract the right attention from targeted shoppers. By collecting and analysing shopper data from online purchases, retailers can pinpoint the best location to open a pop-up.

It’s all about the brand’s target market. Who is your ideal customer? If they are Millennials, you’re more likely to benefit from a CBD or inner suburb location, or an area surrounded by other stores popular among younger shoppers. Rather than tailoring your location to heavily populated areas, opt for places where your unique target market already exists and drive footfall that way.

MEASURING SUCCESS & DELIVERING ON THE PROMISE OF SUCCESS

Traditionally, transactional numbers are the best metric to evaluate the success of a retail roll-out but I prefer a different approach.

The traditionalist in me would measure success translated through revenues and profit, but the number of customers walking through your store proves their interest in and awareness of your brand, which is just as valuable as making a sale.

The potential of a customer to become a loyal follower of a brand is thus just as important as the transactional act of selling a product.

“Footfall is often just as important as transactional success measured through revenue and profit”

Social media coverage also serves as a valuable metric for successful engagement. In the digitally-driven age, pop-ups are ideal for social media engagement. Brands are looking for compelling content to share and consumers are looking for compelling content to engage with. An event might get 30 000 people to attend, but it holds potential for another 300 000 impressions online.

In Part 2 of the article, I will be sharing some pop-up experiences that use the experiential approach to draw in the Millennials and Gen Z crowds.

Beginning with the vision of the branded experience, X-Factor Displays, guides clients throughout the entire lifecycle of the pop–up experience. Whether your next pop-up is for brand awareness, test a new market, or drive buzz and media exposure, get in touch with me to make it a successful one. Some of my clients to date include Samsung, Emirates Leisure Retail Group, ANZ and Hanes (Bonds, Maidenform, Jockey).

X-Factor Displays, a greater group partner company and leading retail display and activation agency that designs and manufactures customised retail displays to guide brands in re-imagining their purpose and customer engagement strategies.